Stationary Energy Storage: Innovations in Li-ion Battery Technologies

Author: Conrad Nichols, Senior Technology Analyst at IDTechEx

Li-ion batteries remain the dominant electrochemical energy storage technology in the global market. As written in their new market report, IDTechEx estimates that in 2023 alone, 92.3 GWh of Li-ion BESS (battery energy storage system) was deployed globally across market sectors, including grid-scale, commercial and industrial (C&I), and residential battery storage markets. Other battery storage technologies, such as redox flow batteries, Na-ion batteries, and metal-air batteries, have continued to remain as emerging technologies with a limited volume of deployments in the last few years.

The growth of the Li-ion battery energy storage system (BESS) market has been facilitated by fast cost reductions of the technology and its improved performance characteristics through continued development. BESS manufacturers have continued to develop systems that promise improved safety properties and greater energy densities. These performance characteristics are important for BESS customers and will often be considered when acquiring BESS for grid-scale projects, alongside, of course, other crucial metrics such as cost, cycle life, duration of storage, and C-rate. The launch of ‘zero-degradation’ BESS technologies, such as the TENER technology from CATL, has also sparked interest in the industry. Continued technology innovation will help facilitate the dominance of Li-ion BESS in the stationary battery storage market over the coming years. IDTechEx’s market report, “Batteries for Stationary Energy Storage 2025-2035: Markets, Forecasts, Players, and Technologies”, suggests that the Li-ion BESS market will reach US$109B in value by 2035.

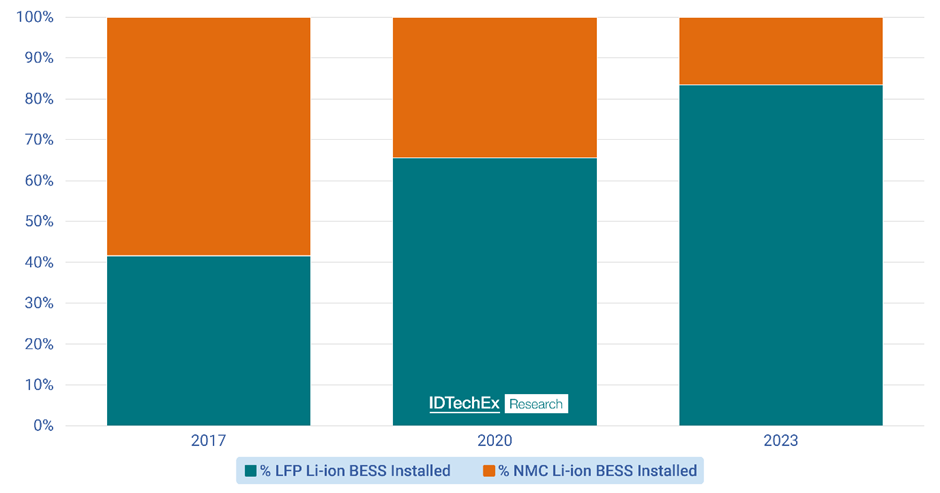

The shift to and dominance of the LFP chemistry

Over the last decade, NMC and LFP chemistries have been the most used for Li-ion BESS. LFP chemistries are less expensive due to the lack of cobalt and nickel in the cathode, have a longer cycle life, and generally possess a lower risk of thermal runaway occurring (thus potentially being regarded as safer). Therefore, the chemistry split for deployed Li-ion BESS has gradually been shifting to a more dominant share of LFP due to these advantages. While most LFP cell production is concentrated in China, more gigafactory plans are being announced, which will see the manufacturing and supply of LFP cells for BESS become more localized in different countries over the next decade. For more analysis and discussion on Li-ion BESS chemistry trends for grid-scale and residential battery storage markets, please refer to the IDTechEx report.

Global Li-ion Battery Storage Annual Installations by Chemistry Split (%). Source: IDTechEx

Developments in BESS energy density

Despite these advantages, LFP cells possess a lower energy density compared to NMC cells. Energy density is an important metric in the high-performance electric vehicle (EV) sector, as EV battery packs with greater energy density facilitate greater driving range. However, energy density has historically been less of a crucial factor for stationary energy storage applications. However, more BESS manufacturers and integrators are shifting to LFP; thus, differences in performance metrics between players' technologies are becoming less extreme. Therefore, optimizing system-level energy density is becoming more important as players aim to differentiate and position themselves in an increasingly competitive market. This has been achieved by using LFP cells with larger form factors. Cells with larger form factors possess a higher energy. However, and more importantly, using cells with larger form factors has led to more BESS container volume being dedicated to cells rather than dead space, thermal management, or power conversion systems (PCS), thus increasing the system-level energy density. Achieving this can save floor space for customers whose project sites may be more spatially constrained. Moreover, as fewer containerized systems would be needed for a given project capacity (MWh), this could bring cost savings for customers at project-level due to reduced installation times.

Key examples in the market see Narada Power announcing the use of 320 Ah cells, with a 390 Wh/L cell-level volumetric energy density, for a 5.11 MWh 20ft containerized BESS. CATL also announced its new 6.25 MWh 20ft containerized BESS, named TENER, where cells used to have an energy density of 430 Wh/L. While this presents a ~25% increase in system-level energy density compared to many of the 5 MWh BESS launched by Chinese BESS manufacturers in the last year, CATL have also claimed that the technology exhibits zero degradation in the first five years of use.

Claims of zero-degradation BESS

CATL reported the development of biomimetic SEI and self-assembly electrolytes as enablers of ‘zero-degradation’ performance. Biomimetic typically reports to structures, processes, or methods of production that copy or take inspiration from biological structures or processes. As explained in the IDTechEx report, the ‘zero-degradation’ claim is likely to be a combination of factors beyond just SEI and electrolyte design and likely to extend to the use of pre-lithiation additives during cell manufacturing. Also, the operation of the battery management system (BMS) may be altered over the course of the battery lifetime to allow the customer to perceive the battery as undergoing ‘zero-degradation’ while, in fact, some form of degradation will still be occurring in the cells. The IDTechEx report provides further depth of analysis on the CATL ‘zero-degradation’ BESS and how this may be achieved or perceived.

Li-ion battery storage technology outlook

Li-ion batteries will remain the dominant BESS technology in the medium term. The technology is well understood and has been successfully demonstrated in grid-scale projects reaching GWh-scale. Annual deployments of Li-ion BESS have been growing globally at a remarkable pace, reaching over 90 GWh in 2023. Continued development of technologies from cell and BESS manufacturers to improve performance characteristics will help Li-ion technologies upkeep market dominance. Ongoing innovation will also be key for any one player to remain competitive, especially given that more players have moved to adopting the LFP chemistry. In the past, differences in performance metrics and cost of Li-ion BESS were more extreme between technologies using LFP rather than NMC cells. This allowed companies selling these systems to more easily express the advantages of their technology. In the current market, BESS manufacturers have launched Li-ion BESS with greater system-level energy densities to elevate their market position, while also bringing potential cost reductions for customers at project-level. This has been achieved using cells with larger form factors, and this is a key trend expected to continue and strategy to be adopted by a growing number of players.

For more detailed information on Li-ion BESS and other battery storage technologies, trends, benchmarking, battery storage safety, and thermal management, key players and project pipelines, grid-scale and residential battery storage markets, regional analysis such as incentives, schemes, and energy storage targets, applications, business models, and revenue streams, please refer to IDTechEx’s new market report “Batteries for Stationary Energy Storage 2025-2035: Markets, Forecasts, Players, and Technologies”.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/SES.

For the full portfolio of batteries and energy storage market research available from IDTechEx, please see www.IDTechEx.com/Research/E