|

Author: Chingis Idrissov, Technology Analyst at IDTechEx The clean hydrogen market is poised for significant growth, driven by the increasing focus from companies and governments on developing green hydrogen infrastructure to decarbonize hard-to-abate industries. The electrolyzer is a key component of the green hydrogen plant, responsible for the splitting of water molecules into hydrogen and oxygen using renewable energy. IDTechEx forecasts the annual water electrolyzer market value to exceed US$70 billion by 2034, representing a CAGR of 40.7% over 2024-2034. This substantial growth will be driven by an array of factors, ranging from overarching market drivers, such as national low-carbon hydrogen targets, to technological developments and electrolyzer manufacturing capacities. This article provides an overview of some key drivers as well as future directions for the electrolyzer market.

|

||

|

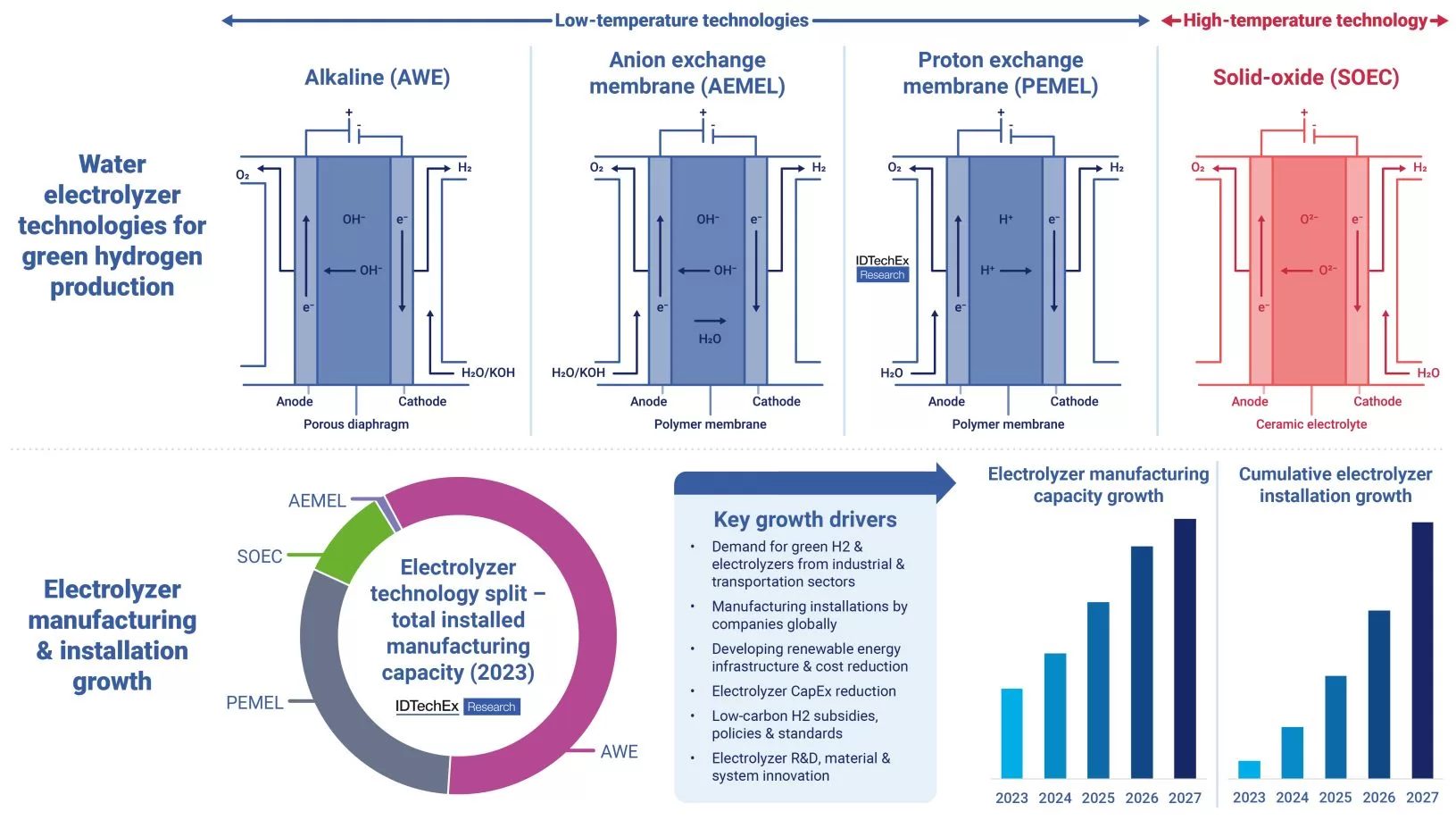

Water electrolyzer technologies for green hydrogen production and electrolyzer manufacturing & installation growth. Source: IDTechEx |

||

|

Grey hydrogen production & key application markets for low-carbon hydrogen Currently, the hydrogen production landscape is dominated by the thermocatalytic reforming of natural gas, primarily steam methane reforming (SMR), which produces grey hydrogen. The next dominant process is coal gasification, using either black or brown coal, leading to black/brown hydrogen. Together, fossil fuel-based production of hydrogen accounts for over 98% of all hydrogen produced, with low-carbon hydrogen (green and blue) occupying the small remaining share. Fossil fuel-based production assets feed hydrogen into critical industries, mainly petroleum refining and ammonia production used for fertilizers. Other key industries where hydrogen could be used include steel production, power and heat generation, and the production of other chemicals and fuels, such as methanol. Most of these sectors are difficult to decarbonize using direct electrification, but transitioning to low-carbon hydrogen has the potential to progressively remove emissions from these industries. While the sectors creating the most immediate demand are industrial, transportation sectors are increasingly looking towards low-carbon hydrogen as a decarbonization tool. IDTechEx predicts that FCEVs will account for just 4% of zero-emission vehicles on the road in 2044 due to heavy competition with battery electric vehicles (BEVs) and various adoption challenges, but the opportunity is greater in certain market segments, particularly in heavy-duty trucks. The maritime and aviation sectors will be difficult to electrify, so this is where hydrogen-fueled marine vessels and aircraft can gain a more significant market share compared to battery-powered alternatives. Ultimately, all the mentioned industrial and transport applications create a market for low-carbon hydrogen. Recent developments in low-carbon hydrogen policies The low-carbon hydrogen policy landscape has seen significant advancements across key regions in recent years, reflecting a growing global interest in hydrogen as a critical tool for decarbonization. The US has passed its Inflation Reduction Act (IRA) in 2022, which includes tax credits for “clean hydrogen” production (US$ 0.6 – 3 per kg H2 under the 45V tax credit), and the DOE announced US$7B of funding for six to ten Regional Clean Hydrogen Hubs (H2Hubs) in 2023. The UK government has announced that it will provide over £2 billion of revenue support for their Hydrogen Production Business Model, and in 2023 contracts for difference (CfDs) were offered to support 11 projects (125MW total capacity) as part of the Electrolytic Hydrogen Allocation Round 1 (HAR1). In the EU, the first European Hydrogen Bank auction was launched in 2023, offering €800M of subsidies for green hydrogen production, and a second auction is planned for the spring of 2024. The Japanese government plans to provide 3 trillion yen (US$20.3B) over the next 15 years to subsidize low-carbon hydrogen production. Many other governments worldwide are also announcing hydrogen strategies and providing funding mechanisms for projects. These include key economies such as Australia, China, South Korea, South Africa, and Saudi Arabia, among many others. The overall narrative is that significant funding and efforts are being allocated to low-carbon hydrogen production, with green hydrogen gaining the most attention and funding. Different types of water electrolyzers & key technological developments There are four main types of electrolyzer technology that can be used to produce green hydrogen: alkaline water (AWE or AEL), proton exchange membrane (PEMEL or PEMWE), anion exchange membrane (AEMEL or AEMWE), and solid oxide electrolyzers (SOEC or SOEL). Each technology comes with its own set of performance characteristics, commercial maturity, and various advantages and limitations. IDTechEx’s market report, “Green Hydrogen Production & Electrolyzer Market 2024-2034: Technologies, Players, Forecasts”, provides an analysis and comparison of the different electrolyzer systems available, covering working mechanisms, materials employed, and system performance, amongst other factors. Alkaline water electrolyzers (AWE) have long been commercial and used for industrial applications. They are characterized by their lowest capital costs (CapEx) and longer stack lifetimes compared to other technologies. They are also the most mature in terms of manufacturing, with large gigawatt-scale production facilities operating globally. The combination of these factors makes them a popular choice for large-scale green hydrogen projects. PEM electrolyzers (PEMEL) are characterized by higher power densities and output hydrogen pressures, as well as faster response times than alkaline systems. This generally makes them better suited to coupling with renewable energy sources directly. PEMEL systems previously lagged behind AWE commercially but are now ready to compete with AWE systems in green hydrogen project installations. PEMEL systems remain more expensive than AWE, but the last few years have seen a larger number of projects adopting PEMEL technology, although of smaller system size compared to AWE. SOEC is a relatively recent electrolyzer technology to reach commercial deployment, driven by advancements in solid oxide fuel cells (SOFC). Operating at high temperatures (>600°C), they offer higher system efficiencies but are expensive and require further improvements. However, their higher temperatures and efficiency compared to low-temperature technologies offer several advantages. For example, SOEC systems can reuse waste process heat and co-electrolyzer H2O and CO2-producing syngas, which makes them well-suited for coupling with industrial applications. AEMEL is the youngest and least commercially mature technology on the market. AEMEL aims to combine the benefits of AWE and PEMEL systems – low-cost and abundant materials of AWE with the higher efficiencies and dynamic response rates of PEMEL. The number of players developing AEMEL is limited, but it is likely to gain more market players and presence in commercial green hydrogen projects. Electrolyzer manufacturers – recent industry trends & their implications Global electrolyzer manufacturing capacity is expected to increase significantly over the next 5 years as players look to capture a share of this growing market. IDTechEx analysis shows that European and Chinese companies are particularly active in their plans to expand and grow their electrolyzer manufacturing capacities and capabilities. Significant investment into electrolyzer manufacturing is also expected from North American, Indian, and other regional players, which are looking to expand market shares. The electrolyzer market is currently dominated by alkaline (AWE) and PEM electrolyzer manufacturers, with comparatively fewer companies manufacturing or commercializing SOEC and AEMEL systems. AWE and PEMEL will most certainly lead in terms of future manufacturing capacity as well as adoption in green hydrogen project installations. IDTechEx expects AWE to dominate across larger-scale projects, while PEMEL will mainly see adoption in small- to medium-scale projects in the shorter term and larger projects in the medium to longer term. The similarity between solid oxide electrolyzers and solid oxide fuel cells, as well as shared aspects of AEMEL to AWE and PEMEL systems, could provide a significant entry point for these technologies into the green hydrogen market. Due to the previously mentioned advantages, IDTechEx expects SOEC to be coupled primarily with industrial assets. On the other hand, AEMEL systems can potentially address a wider range of applications, including hydrogen refueling stations. Enapter is a leading AEMEL supplier and is seeing high interest in its products from a wide range of sectors. Future growth drivers & IDTechEx outlook on the water electrolyzer market Certainly, growth in the electrolyzer market across all four electrolyzer types will be needed to meet ambitious national and regional targets for green and clean hydrogen production. Ultimately, one of the most important parameters is likely to be the levelized cost of hydrogen (LCOH), which is heavily influenced by the price of renewable electricity as well as the capital cost (CapEx) of the green hydrogen plant. IDTechEx expect that key drivers behind LCOH reduction will be improvements in electrolyzer technology and scaling up of manufacturing facilities, which will ultimately lead to CapEx reductions. More importantly, securing low-cost renewable electricity, establishing hydrogen off-take agreements, and obtaining government grants, tax credits, and subsidies will be critical for the commercial viability of green hydrogen projects and further LCOH reduction. The new IDTechEx report, “Green Hydrogen Production & Electrolyzer Market 2024-2034: Technologies, Players, Forecasts”, forecasts significant growth in the green hydrogen market, both in terms of project installations and electrolyzer manufacturing capacity, offering 10-year market forecasts in gigawatts (GW) of electrolyzer capacity and US$ billions (US$B) for the key electrolyzer technologies: AWE, PEMEL, AEMEL and SOEC. The report also includes discussion of novel electrolysis technologies (e.g. seawater & CO2 electrolysis), comprehensive analysis of electrolyzer manufacturers by state of development and commercial system specifications, analysis of manufacturing capacities technology and region, green hydrogen project case studies as well as outlooks on future electrolyzer technology adoption. To find out more about this market report, including downloadable sample pages, please visit www.IDTechEx.com/Electrolyzer. For the full portfolio of Energy & Decarbonization research from IDTechex, please visit www.IDTechEx.com/Research/Energy. Upcoming free-to-attend webinar Technology & Market Developments for Electrolyzers in Green Hydrogen Production Chingis Idrissov, Technology Analyst at IDTechEx and author of this article, will be presenting a free-to-attend webinar on the topic on Thursday 28 March 2024 – Technology & Market Developments for Electrolyzers in Green Hydrogen Production. Key takeaways from this webinar will include: – Introduction to the hydrogen economy and green hydrogen production – Overview of the incumbent electrolyzer technologies – Current state of electrolyzer manufacturing and market – Key innovations needed in electrolyzer technology & overview of novel technologies – Electrolyzer market growth drivers and market outlook Please click here to check timings and register for your specific time zone. If you are unable to make the date, please register anyway to receive the links to the on-demand recording (available for a limited time) and webinar slides as soon as they are available. |